Balbharti Maharashtra State Board Class 11 Economics Important Questions Chapter 5 Rural Development in India Important Questions and Answers.

Maharashtra State Board 11th Economics Important Questions Chapter 5 Rural Development in India

1A. Choose the correct option and rewrite the sentence:

Question 1.

Short term loans not exceeding two years are taken ___________

(a) to buy tractor

(b) to make improvements on land

(c) for meeting expenses on religious or social ceremonies

(d) for digging up of canals

Answer:

(c) for meeting expenses on religious or social ceremonies

Question 2.

Non-institutional sources of agricultural credit are related to ___________

(a) the loan provided by landlords, money-lenders, traders, etc.

(b) NABARD, which is an apex institution in rural credit structure.

(c) Rural Co-operative credit institutions.

(d) Commercial banks establish branches to provide credit.

Answer:

(a) the loan provided by landlords, money-lenders, traders, etc.

Question 3.

The service sector termed as ‘tertiary sector’ ___________

(a) has been subdivided into agriculture and allied activities.

(b) includes transport, restaurants, tourism, etc.

(c) is concerned with the processing of raw materials.

(d) consists of the plantation, forestry, fisheries, dairy, etc.

Answer:

(b) includes transport, restaurants, tourism, etc.

Question 4.

Rural development leads to an increase in rural incomes and standard of living.

(a) It is related to only agricultural development.

(b) Indian economy is predominantly an urban economy.

(c) Credit has to be used for personal consumption only.

(d) This helps in the eradication of poverty.

Answer:

(d) This helps in the eradication of poverty.

Question 5.

Agricultural policies have been reviewed from time to time.

(a) so as there are adequate savings to finance farming.

(b) as India’s economic growth depends upon agricultural development only.

(c) so as to provide adequate and timely finance to the rural sector.

(d) so as to restrict money lenders from charging a high rates of interest.

Answer:

(c) so as to provide adequate and timely finance to the rural sector.

1B. Complete the correlation:

Question 1.

Industrial Sector : Cottage Industries : : Service Sector : ___________

Answer:

Transport

Question 2.

___________ : Allied Activities : : Industrial Sector : Rural Industries.

Answer:

Agricultural Sector

Question 3.

Purchase of Tractor : ___________ : : Loans for Marriages : Unproductive Loans.

Answer:

Productive Loan

Question 4.

Institutional Sources : Regional Rural Banks : : ___________ : Money Lenders.

Answer:

Non-institutional Sources

Question 5.

Short term Credit Co-operatives : State Co-operative Banks : : Long term Credit Co-operatives : ___________

Answer:

State Co-operative Agriculture and Rural Development Banks.

1C. Suggest the economic terms for the given statements:

Question 1.

The strategy is designed to improve the economic and social life of a specific group of people.

Answer:

Rural Development

Question 2.

Division of Agricultural sector.

Answer:

tertiary sector

Question 3.

An industrial activity concerned with the processing of raw materials.

Answer:

final consumers

Question 4.

Sector concerned with services to business and the final consumer.

Answer:

traders, professionals and technicians

Question 5.

Loan not exceeding two years.

Answer:

economic growth

Question 6.

Loan up to a period of five years.

Answer:

purchase of fertilizers and HYV seeds

Question 7.

Loan for a period of more than five years.

Answer:

buying cattle or agricultural equipment

Question 8.

Justified loan related to agricultural production.

Answer:

Productive loan

Question 9.

A loan used for personal consumption.

Answer:

Unproductive loan

Question 10.

A banking institution to provide finance for agriculture and rural development.

Answer:

Government of India

1D. Find the odd word out.

Question 1.

Agricultural Sector – Plantation, Forestry, Fisheries, Restaurant

Answer:

Restaurant

Question 2.

Service Sector – Computer Service, Horticulture, Tourism, Restaurant

Answer:

Horticulture

Question 3.

Terms related to Rural Development in India – Public health, Literacy, Suppression of women power, Land reforms.

Answer:

Suppression of women’s power.

1E. Complete the following statements:

Question 1.

A strategy designed to improve the economic and social life of a specific group of people is called ___________

Answer:

Rural Development

Question 2.

The service sector is also termed as ___________

Answer:

Agriculture and Allied activities

Question 3.

The service sector involves services to business as well as ___________

Answer:

Industrial sector

Question 4.

The service sector is further classified into ___________

Answer:

Service sector

Question 5.

Appropriate strategies for rural development will lead to ___________

Answer:

Short term credit

Question 6.

Short term credit is required for ___________

Answer:

Medium-term credit

Question 7.

Medium-term credit is taken for ___________

Answer:

Long term credit

Question 8.

Purchase of tractor, land, seeds, etc are the examples of ___________

Answer:

Productive loan

Question 9.

Loan taken for expenditure on marriage or religious ceremony is called as ___________

Answer:

Unproductive loan

Question 10.

NABARD today is fully owned by ___________

Answer:

NABARD

1F. Choose the wrong pair:

Question 1.

| Strategies for Rural Development | Effect |

| 1. Public health and Sanitation | (a) Improvement in the quality of life |

| 2. Empowerment of women | (b) Reduce gender disparity |

| 3. Enforcement of law and order | (c) Eradication of poverty |

Answer:

Wrong Pair: Enforcement of law and order – Eradication of poverty

Question 2.

| Plans for Rural Development | Related Factors |

| 1. Land reforms | (a) Protection of tenancy rights |

| 2. Infrastructure development | (b) HYV seeds |

| 3. Availability of credit | (c) Financial institutions |

Answer:

Wrong Pair: Infrastructure development – HYV seeds

Question 3.

| Institutional Sources of Agricultural Credit | Provision of Finance |

| 1. NABARD | (a) For Agricultural and Rural Development |

| 2. Long-term credit Co-operatives | (b) Operate at Village and State level |

| 3. RRB’s | (c) Cater to the needs of urban poor |

Answer:

Wrong Pair: RRB’s – Cater to the needs of urban poor

Question 4.

| Abbreviations | Full Forms |

| 1. PACS | (a) Primary Agricultural Credit Society |

| 2. DCCB | (b) Development Central Co-operative Banks |

| 3. SCB | (c) State Co-operative Banks |

Answer:

Wrong Pair: DCCB – Development Central Co-operative Banks

2. Identify and explain the concepts from the given illustrations:

Question 1.

Govind bought a bullock by taking a loan for a period of 5 years.

Answer:

Medium Term Loan.

The medium-term loan is taken for a period of 5 years and it is generally taken to buy cattle or agricultural equipment or digging up of canals.

Question 2.

Surekha established a handloom industry to cater to the needs of the rural poor in the village.

Answer:

Cottage Industry.

The cottage industry is a manufacturing activity carried in the house of an individual. It is a small-scale industry with a minimum amount of investment, making job opportunities for the rural people in the village.

Question 3.

Gulabrao took money from a landlord for the marriage of his son.

Answer:

Unproductive Loan.

The unproductive loan is taken for personal consumption purposes. It is not related to productive activities like loans taken for marriages or to perform religious ceremonies.

Question 4.

There was a considerable socio-economic change in ‘Jamdul’ village after the generation of electricity.

Answer:

Infrastructure Development.

Infrastructure development is a result of rural development programmes. It leads to further progress of an economy.

Question 5.

Nand Kumar started a cyber cafe near the bus stand to provide computer services.

Answer:

Service Sector.

The service sector involves the provision of services to businesses as well as services to final consumers like accounting

services, mechanical services, plumbing services, computer services, etc.

3. Assertion and Reasoning questions:

Question 1.

Assertion (A): Money lending has been a widely prevalent profession in villages.

Reasoning (R): Commercial Banks provide rural credit by establishing their branches in rural areas. Options:

(i) (A) is true, but (R) is False.

(ii) (A) is false, but (R) is True.

(iii) Both (A) and (R) are true and (R) is the correct explanation of (A).

(iv) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

Answer:

(iv) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

Question 2.

Assertion (A): Protection of Tenancy rights leads to a reduction in rural inequality.

Reasoning (R): Rural development ensures effective implementation of land reforms.

Options:

(i) (A) is true, but (R) is False.

(ii) (A) is false, but (R) is True.

(iii) Both (A) and (R) are true and (R) is the correct explanation of (A).

(iv) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

Answer:

(iii) Both (A) and (R) are true and (R) is the correct explanation of (A).

Question 3.

Assertion (A): Short-term loans are not exceeding two years.

Reasoning (R): They are generally required for digging up canals.

Options:

(i) (A) is true, but (R) is False.

(ii) (A) is false, but (R) is True.

(iii) Both (A) and (R) are true and (R) is the correct explanation of (A).

(iv) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

Answer:

(iv) Both (A) and (R) are true but (R) is not the correct explanation of (A).

Question 4.

Assertion (A): Literacy is a powerful instrument of socio-economic change.

Reasoning (R): Unproductive credit is economically justified.

Options:

(i) (A) is true, but (R) is False.

(ii) (A) is false, but (R) is True.

(iii) Both (A) and (R) are true and (R) is the correct explanation of (A).

(iv) Both (A) and (R) are true, but (R) is not the correct explanation of (A).

Answer:

(i) (A) is true but (R) is False.

4. Distinguish between:

Question 1.

Short Term Credit and Medium Term Credit.

Answer:

| Short Term Credit | Medium-Term Credit |

| (i) It refers to a loan not exceeding 2 years. | (i) It refers to a loan for a period of up to 5 years. |

| (ii) It is taken to fulfill short-term requirements like the purchase of fertilizers, buying of HYV seeds, for meeting expenses of religious or social ceremonies, etc. | (ii) It is taken to make improvements on the land, buying cattle, or agricultural equipment, digging of canals, etc. |

Question 2.

Medium-Term Credit and Long Term Credit.

Answer:

| Medium-Term Credit | Long Term Credit |

| (i) It refers to a loan for a period of up to 5 years. | (i) It is taken for a period of more than 5 years. |

| (ii) It is taken to make improvements on the land, buying cattle, or agricultural equipment, digging of canals, etc. | (ii) It is generally taken to buy tractors, making permanent improvements on the land, etc. |

Question 3

Short Term Credit and Long Term Credit.

Answer:

| Short Term Credit | Long Term Credit |

| (i) It refers to a loan not exceeding 2 years. | (i) It is taken for a period of more than 5 years. |

| (ii) It is taken to fulfill short-term requirements like the purchase of fertilizers, buying of HYV seeds, for meeting expenses of religious or social ceremonies, etc. | (ii) It is generally taken to buy tractors, making permanent improvements on the land, etc. |

Question 4.

Productive Loan and Unproductive Loan.

Answer:

| Productive Loan | Unproductive Loan |

| (i) Loan which is taken for agricultural production purposes is called a productive loan. | (i) Loan which is taken for unproductive purposes is called an unproductive loan. |

| (ii) Eg. purchase of tractor, land or seeds or agricultural equipment, etc. | (ii) Eg. expenditure on marriages or religious ceremonies. |

| (iii) It is an investment. It increases farmers’ income in the future. | (iii) It is an expenditure. It increases the debt burden of the farmers. |

Question 5.

Non-institutional Sources of Agricultural Credit and Institutional Sources of Agricultural Credit.

Answer:

| Non-institutional Sources of Agricultural Credit | Institutional Sources of Agricultural Credit |

| (i) It includes money lenders, traders, landlords, commission agents, friends, and relatives, etc. | (i) It includes commercial banks, Regional Rural Banks (RRBs), Rural Co-operative Credit Institutions, etc. |

| (ii) It is easy to obtain loans from non-institutional sources. The procedure is very simple and less time-consuming. | (ii) There are many formalities to obtain loans from institutional sources. The procedure is complicated and time-consuming. |

| (iii) In this case, a very high (exorbitant) rate of interest is charged. | (iii) In this case, the rate of interest is low. |

| (iv) There is no restriction on the use of loans taken from non-institutional sources. | (iv) The loan provided by institutional sources is restricted to use for productive activities only. |

5. Answer the following questions:

Question 1.

Explain Rural occupational structure.

Answer:

Rural development is necessary to improve the economic and social life of the rural people.

The rural occupational structure can be classified as follows:

- Agricultural sector

- Industrial sector

- Service sector

(a) Agricultural sector: The rural population in India is mainly engaged in the agricultural sector. It is sub-divided as agriculture and allied activities. Agriculture consists of small marginal and large farmers. Allied activities include plantation, poultry farming, fisheries, forestry, dairy, horticulture, mining, etc.

(b) Industrial sector: It includes economic activities related to the processing of raw materials and the manufacture of goods. Occupations related to construction work, electricity, banking, insurance, trade, finance, education, etc., also fall under the Industrial sector. It is further classified as a small-scale industry, cottage industry, and rural industry.

(c) Service sector: It is also called the tertiary sector. It includes services like accounting services, mechanic or plumbing services, banking and insurance, computer service, etc. It is further classified into traders, transport operators, professionals, and technical.

Question 2.

Write a short note on NABARD.

Answer:

NABARD:

- NABARD is the Apex banking institution. National Bank for Agricultural and Rural Development was established on 12th July 1982, with a paid-up capital of ₹ 100 crores. 50% contribution was paid by the government and 50% by RBI.

- NABARD plays an energetic role in strengthening and re-organizing the credit structure in the country.

- NABARD provides credit to agriculture, small-scale industries, cottage and village industries, handicrafts, and other allied activities.

- The money required by the primary agricultural credit societies is provided by NABARD. It reduces regional imbalances.

- Today, NABARD is fully owned by the Government of India. NABARD is connected to district and state co-operative banks and RRB’s (Regional Rural Banks) for rural development.

Question 3.

Explain the term Micro Finance Institutions (MFIs).

Answer:

Micro Finance Institutions (MFIs):

- They offer rural credit on concessional interest rates.

- The beneficiaries of this scheme are the marginal farmers, landless labourers, artisans, and craftsmen in the rural areas.

- However, small farmers are unable to access rural credit.

- It is due to its inflexible procedure and high transaction cost.

- Thus, NGOs (Non- government Organisations) help the rural poor.

Question 4.

Explain Rural Co-operative Credit Institutions.

Answer:

Agricultural credit is an important prerequisite for agricultural growth.

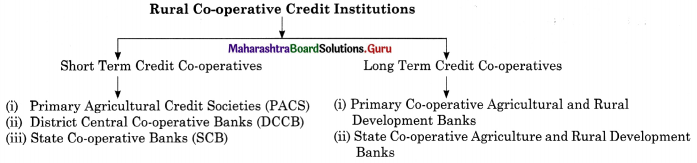

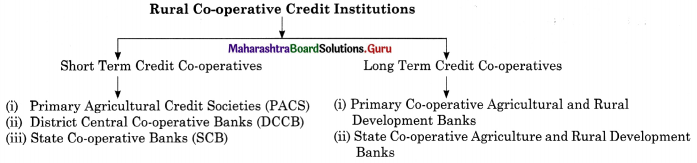

Classification of Rural Co-operative Credit Institutions are as follows:

The rural co-operative credit institutions are divided into short-term credit co-operatives and long-term credit co-operatives.

(i) Short-term credit Co-operatives provide short-term rural credit. They are based on a three-tier structure.

Primary Agricultural Credit Societies operate at the village level, DCCB at the district level, and SCB at the state level.

(ii) Long-term credit Co-operatives meet the long-term requirements of the farmers. They are organized at two levels. Primary Co-operative Agriculture and Rural Development Banks operate at the village level as an independent unit. State Co-operative Agriculture and Rural Development Banks operate at the state level through their branches in different villages. They provide credit to the rural and agricultural sectors for their development.

Question 5.

Explain Non-institutional Sources of Credit.

Answer:

Non-Institutional Sources of Credit:

Non-institutional sources of credit play a prominent role in supplying rural credit.

The important sources of non-institutional credit are as follows:

(i) Moneylenders: It is easy to obtain loans from money lenders as the lenders and borrowers are known to each other. Easy access, simple procedure, and no restriction on the use of land attract farmers towards this loan. However, money lenders mortgage the land and charge high rates of interest on credit. It may result in the indebtedness of farmers.

(ii) Other Private Sources: It includes traders, landlords, commission agents, relatives, and friends, etc. At present, the share of non-institutional finance is declining.

Question 6.

Explain the classification of agricultural credit on the basis of the time period.

Answer:

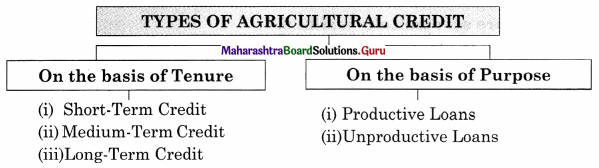

On the basis of tenure (time period), agricultural credit is classified as follows:

- Short Term credit

- Medium Term credit

- Long Term credit

(i) Short Term Credit: It is required for consumption and to carry out farming and other activities. It is for a period not exceeding 2 years. It is taken to meet expenses on purchasing fertilizer, fodder, HYV seeds as well as to meet religious expenses or expenses of social ceremonies. These loans are normally repaid after the harvest period.

(ii) Medium Term Credit: The period for these loans is up to 5 years. It is mainly needed to purchase cattle, equipment, to make improvements on the land, to dig up canals, etc.

(iii) Long Term Credit: When farmers borrow a loan for a period of more than 5 years, it is called a long-term loan. It is mainly used to buy additional land, irrigation, making permanent improvements on the land, etc.

Question 7.

Explain the classification of agricultural credit on the basis of purpose.

Answer:

Agricultural credit is an important prerequisite for agricultural growth.

On the basis of purpose there are two types of agricultural credit which is as follows:

- Productive loan

- Unproductive loan.

(i) Productive loans: Productive loans are those which are related to agricultural equipment. Productive loans help to increase farmers’ income in the future.

(ii) Unproductive loans: Unproductive loans are used for personal consumption.

e.g. loans are taken for religious and social celebrations, birth and death ceremonies, expenditure on marriages, etc.

Unproductive loans increase the debt burden of the farmers.

6. State with reasons whether you agree or disagree with the following statements:

Question 1.

Unproductive loans are economically justified.

Answer:

No, I do not agree with the statement.

- Productive loans are economically justified as they are used for production purposes.

- Unproductive loans are used for personal consumption and are not related to productive activity.

- Eg. loans for expenditure on marriages or religious ceremonies.

- Thus, unproductive loans are not economically justified.

Question 2.

RRBs are set up as rural-oriented commercial banks with a low-cost profile of co-operatives.

Answer:

Yes, I do agree with the statement.

- RRBs cater to the needs of the rural poor.

- RRBs work with the professional decision and modern outlook of commercial banks.

- They are specialized banks established under RRB Act, 1976.

- Thus, we can say RRBs are rural-oriented commercial banks.

Question 3.

The interest charged by the money lenders is usually very low.

Answer:

No, I do not agree with the statement.

- Moneylenders are the private lenders of credit.

- They fall under the non-institutional sources of agricultural credit.

- They provide loans to farmers against land or other assets as collateral security.

- Thus, they charge a high rate of interest and mortgage the property of the cultivators.

Question 4.

Long Term Credit is for a period of up to 5 years.

Answer:

No, I do not agree with the statement.

- Long Term loans are generally taken by the farmers to buy farming equipment, tractor, additional land, to make permanent improvements on the land, or to pay old debts, etc.

- It is generally bigger in amount, hence, it is taken for a longer period of time for more than 5 years.

- A longer period makes repayment easier for the borrowers.

- Thus, it is taken for more than 5 years period.

7. Answer in detail:

Question 1.

Write the significance of Rural Development in India.

Answer:

The significance of Rural Development in India are as follows:

- Public Health and Sanitation: Rural development helps to improve sanitation and hygiene. It improves the quality of life.

- Literacy Rate: Rural development helps to increase the literacy rate. It helps to make provisions for educational facilities.

- Empowerment of Women: Rural development helps to reduce gender disparity. It also encourages women’s participation in community development programs.

- Enforcement of Law and Order: Rural development helps to safeguard the rights of the rural people.

- Land Reforms: Rural development results in effective implementation of land reforms like regulation

of rent, protection of tenancy rights, etc. It reduces rural inequality. - Infrastructural Development: Infrastructure refers to all those services and facilities which are necessary for economic growth. Rural development leads to infrastructural development, e.g. power generation, transportation, irrigation, banking, etc.

- Availability of Credit: Rural development also leads to an increase in financial institutions like credit societies, RRB’s, Cooperative banks, etc. The provision of credit helps the farmers to improve their standard of living.

- Eradication of Poverty: Due to rural development, there is an increase in rural incomes. It results in the eradication of poverty. In short, rural development is necessary for the overall development of the rural sector and to improve the quality of life.

Question 2.

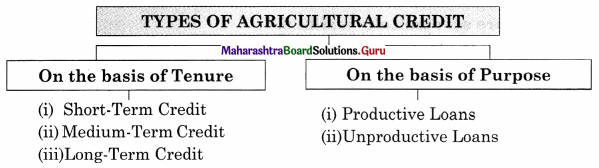

Explain in detail the types of Agricultural Credit.

Answer:

On the basis of tenure (time period), agricultural credit is classified as follows:

- Short Term credit

- Medium Term credit

- Long Term credit

(i) Short Term Credit: It is required for consumption and to carry out farming and other activities. It is for a period not exceeding 2 years. It is taken to meet expenses on purchasing fertilizer, fodder, HYV seeds as well as to meet religious expenses or expenses of social ceremonies. These loans are normally repaid after the harvest period.

(ii) Medium Term Credit: The period for these loans is up to 5 years. It is mainly needed to purchase cattle, equipment, to make improvements on the land, to dig up canals, etc.

(iii) Long Term Credit: When farmers borrow a loan for a period of more than 5 years, it is called a long-term loan. It is mainly used to buy additional land, irrigation, making permanent improvements on the land, etc.

Agricultural credit is an important prerequisite for agricultural growth.

On the basis of purpose there are two types of agricultural credit which is as follows:

- Productive loan

- Unproductive loan.

(i) Productive loans: Productive loans are those which are related to agricultural equipment. Productive loans help to increase farmers’ income in the future.

(ii) Unproductive loans: Unproductive loans are used for personal consumption.

e.g. loans taken for religious and social celebrations, birth and death ceremonies, expenditure on marriages, etc.

Unproductive loans increase the debt burden of the farmers.

Question 3.

Explain the institutional sources of Agricultural Credit in India.

Answer:

The main aim of institutional sources of agricultural credit is to provide timely and adequate credit to farmers for increasing their agricultural productions.

Institutional sources of agricultural credit in India are as follows:

(i) National Bank for Agriculture and Rural Development (NABARD): It is at the top of banking institutions providing finance for agriculture and rural development, promotion of agriculture, small-scale industries, cottage, and village industries, handicrafts, etc. NABARD today is totally owned by the Government of India.

(ii) Rural Co-operative Credit Institutions:

It is divided into:

- Short-term credit co-operatives: This co-operative works through its three-tier structure i.e. PACS, DCCB, and SCB.

- Long-term credit co-operatives: These co-operatives look after the long-term credit requirements of the farmers.

It works through two banks i.e. Primary Co-operative Agriculture and Rural Development Banks and State Co-operative Agriculture and Rural Development Banks.

Primary Co-operative Agriculture and Rural Development Banks work at the village level as an independent unit while State Co-operative Agriculture and Rural Development Banks work at the State level through its branches in villages.

(iii) Commercial Banks (CBs): They provide rural credit by opening their branches in rural areas.

(iv) Regional Rural Banks (RRBs): Such banks are established under RRB Act, 1976. They are rural-oriented with a low-cost profile of co-operatives. They work with professional discipline and the modern outlook of Commercial banks.

(v) Micro Finance Institutions (MFIs): These are the institutions providing financial services to poor people or new businesses that cannot use traditional banking services. Such institutions are generally run by NGOs.

8. Read the following passage carefully and answer the questions given below:

Agriculture is the backbone of the Indian economy to bring about an increase in agricultural production, various programmes have been introduced through economic planning; like the expansion of irrigation facilities, infrastructural development, improving health & nutrition of the rural masses, increasing rural employment, etc.

Traditional agriculture relies heavily on indigenous inputs. Such as the use of organic manures, seeds, simple ploughs, bullocks & primitive agricultural tools.

Modern Technology in agriculture consists of Chemical fertilizers, pesticides, improved varieties of seeds including hybrid seeds, extensive irrigation, use of electricity, agricultural machinery, etc.

Modern technology has increased agricultural mechanization. As a result, industries supplying modern farm inputs have grown at a rapid rate. It has increased the demand for agricultural credit. It has improved productivity. So farmers have become market-oriented.

But, the effects of modern technology prevail only in certain selected areas & the rest of the country is not yet suitable for modern technology. Therefore, low-cost technology has to be introduced for overall rural development.

Question 1.

Highlight the programmes introduced to increase agricultural production.

Answer:

Through economic planning, various programmes have been introduced like the expansion of irrigation facilities, infrastructural development, improving the health and nutrition of the rural masses, increasing rural employment, etc.

Question 2.

What is the difference between traditional and modern technology?

Answer:

Traditional agriculture mainly depends upon indigenous inputs such as the use of organic manures, seeds, simple plough – bullocks, and primitive agricultural tools.

Modern technology in agriculture consists of chemical fertilizers, pesticides, improved varieties of seeds, including hybrid seeds, extensive irrigation, use of electric power, agricultural machinery, etc.

Question 3.

Why did farmers become market-oriented?

Answer:

Modern technology has increased agricultural mechanization. As a result, industries supplying modern farm inputs have grown at a rapid rate. It has increased the demand for agricultural credit. It has improved productivity. Hence, farmers became market-oriented.

Question 4.

Why is it necessary to introduce low-cost technology?

Answer:

The effects of modern technology prevail only in certain selected areas and the rest of the country is not yet suitable for modern technology. Therefore, low-cost technology has to be introduced for overall rural development.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()