Balbharti Maharashtra State Board Class 12 Economics Important Questions Chapter 7 National Income Important Questions and Answers.

Maharashtra State Board 12th Economics Important Questions Chapter 7 National Income

1. A. Choose the correct option:

Question 1.

At present National, Income estimation is done by …………………

(a) Central Statistical Organization

(b) Finance Department

(c) National Income Committee

(d) Reserve Bank of India

Options :

(1) a, b and c

(2) c and d

(3) a and b

(4) only a

Answer:

(4) only a

![]()

Question 2.

National Income is the subject matter of ……………… economics.

(a) Micro

(b) Marco

(c) Managerial

(d) Business

Options:

(1) a and b

(2) only b

(3) only c

(4) None of these

Answer:

(2) only b

Question 3.

National income is a …………… concept

(a) static

(b) final

(c) flow

(d) reserve

Answer:

(a) static

Question 4.

The members of National Income Committee in 1949 were —

(a) Prof. P.C. Mahalanobis and Prof. D.R.Gadgil

(b) Prof. P.C. Mahalanobis and Kaushik Basu

(c) Abhijit Banerjee and Amartaya Sen

(d) Prof. P.C. Mahalanobis, D. R. Gadgil and Dr. V.KR.V. Rao

Answer:

(d) Prof. P.C. Mahalanobis, D. R. Gadgil and Dr. V.KR.V. Rao

Question 5.

According to National Income Committee, NI is ………………….

(a) volume of goods and services

(b) produce in one year

(c) goods and services counted without duplication

(d) all of these

Options :

(1) a and b

(2) a and c

(3) only a

(4) d

Answer:

(4) d

Question 6.

Statements incorrect with reference to A.C. Pigou definition –

(a) National income means national dividend

(b) Objective income of the community

(c) Income from abroad does not include

(d) Income from abroad in money term

Options :

(1) b and c

(2) only a

(3) only c

(4) all of these

Answer:

(3) only c

![]()

Question 7.

While measuring National Income value of ……………….

(a) all goods and services are considered

(b) final goods and services are considered

(c) only intermediate goods are considered

(d) none of these

Options :

(1) a and c

(2) only b

(3) a and b

(4) only d

Answer:

(2) only b

Question 8.

Net income from abroad includes

(a) Difference between export value and import value (X-M)

(b) Difference between receipts and payments made abroad (R-P)

(c) Difference between value of raw material and final goods

(d) None of these

Options :

(1) a and b

(2) b and c

(3) a and c

(4) only c

Answer:

(1) a and b

Question 9.

Three sector economy consists of ……………..

(a) households, business firms and industries

(b) households, business firms and government sector

(c) households, government and foreign sector

(d) all of these

Options :

(1) only a

(2) only b

(3) only c

(4) only d

Answer:

(2) only b

Question 10.

Which of the following is included in j four sector economy?

(a) Households, firms, industries and government

(b) Household, government, firms and organisation foreign sector

Options :

(1) only a

(2) c and d

(3) only d

(4) a and

Answer:

(3) only d

![]()

Question 11.

GDP (Gross Domestic Product) =

(a) C +1 + G + (X-M)

(d) GNP – depreciation

(c) GDP – depreciation

(b) C + I + G + (R-P)

Options :

(1) a

(2) b

(3) c

(4) d

Answer:

(1) a

Question 12.

GNP = C +1 + G + (X-M) + (R-P), R and P represents …………….

(b) R – receipts from abroad

(c) P – payments made abroad

(d) P – payments to government

Options :

(1) a and c

(2) b and c

(3) c and d

(4) a and d

Answer:

(2) b and c

Question 13.

Green Gross National Product (GNP) includes –

(a) Sustainable economic development

(b) Equitable distribution of benefits

(c) Promotes economic welfare

(d) All of these

Options :

(1) a and b

(2) b and c

(3) only c

(4) only d

Answer:

(4) only d

Question 14.

Value added approach is the difference between the value of ……………….

(a) Export and import

(b) Receipts and payment

(c) Inputs and final output

(d) None of these

Options :

(1) a and b

(2) b and c

(3) only c

(4) d

Answer:

(3) only c

Question 15.

Income method of measuring national income is the sum of …………………..

(a) Rent and profit

(b) Rent + Wages + Interest + Profit + MI + (X-M)

(c) C + I + G + (X-M)

(d) Interest + Wages

Options :

(1) a and d

(2) only b

(3) c and d

(4) b and c

Answer:

(2) only b

![]()

Question 16.

Transfer income includes ………………

(a) pension and scholarships

(b) gifts and donations

(c) donations and unemployment allowance

(d) all of these

Options :

(1) a and b

(2) b and c

(3) a and c

(4) d

Answer:

(4) d

Question 17.

WThile estimating National Income by income method the following precautions should be taken –

(a) transfer income should be ignored

(b) all unpaid services should be ignored

(c) income from sale of second hand goods should be ignored

(d) undistributed profits should be ignored

Options :

(1) a and b

(2) c and d

(3) a, b and c

(4) only d

Answer:

(3) a, b and c

Question 18.

In advance countries like USA and UK the ……………….. method of measuring NI is popular.

(a) Output Method / Product Method

(b) Income Method / Factor Cost Method

(c) Expenditure Method / Outlay Method

(d) None of these

Options :

(1) a and b

(2) only b

(3) b and c

(4) d

Answer:

(2) only b

Question 19.

Mixed Income (MI) refers to the income of ………………….

(a) Private and public sector

(b) Self-employed persons

(c) Sale of second hand goods

(d) All of these

Options :

(1) a

(2) b

(3) c

(4) d

Answer:

(2) b

Question 20.

There are many theoretical difficulties in the measurement of NI like –

(a) Transfer Payment

(b) Illegal Income

(c) Unpaid services

(d) All of these

Options :

(1) a and b

(2) b and c

(3) a and c

(4) d

Answer:

(4) d

Question 21.

There are many practical difficulties in the measurement of NI like –

(a) problem of double counting

(b) existence of non-monetize sector

(c) inadequate and unreliable data

(d) none of these

Options :

(1) a and b

(2) b and c

(3) a, b and c

(4) only d

Answer:

(3) a, b and c

![]()

Question 22.

National income is extremely useful for ……………..

(a) formulating national policies on employment, industry, etc.

(b) economic planning

(c) distribution of income

(d) all of these

Options

(1) a and b

(2) b and c

(3) a and c

(4) d

Answer:

(4) d

(B) Complete the correlation

- Personal income : Micro economics :: National Income : …………….

- Two sector economy : Household and business firms :: ……………. : Households, Business firms, Government and Foreign sector

- Three sector economy :Y=C + I + G:: Four sector economy : …………….

- (X-M) : ……………. :: (R-P) : difference between receipts and payment from abroad

- …………….: GDP – Depreciation :: NNP : GNP – Depreciation

- GNP : C + I + G + (X-M) + (R-P) :: ……………. : GNP – (net fall in stock of natural capital + pollution load)

- ……………. : Value of final goods and service ::

Value added approach : Difference between value of output and input - Output Method : Product Method :: ……………. Outlay Method

- ……………. : Unpaid services :: Practical difficulty : Problem of double counting

Answer:

- Marco economics

- Four sector economy

- Y = C + I + G + (X-M)

- Difference between value of export and import

- NDP

- Green GNP

- Final goods approach

- Expenditure Method

- Theoretical difficulty

[C] Give economic terms.

1. The gross market value of all final goods and services produced within a country in a year.

2. When depreciation is deducted from Gross National Product (GNP).

3. When the flow of income is circulated between households and business firms.

4. When value of total production of goods and services in a year is expressed in money term.

5. It is difference between export value and ) import value.

6. Organisation doing estimation of National Income.

7. In this approach value of final goods and services is considered.

8. In this approach value is added at each stage of the production process.

9. It is also known as factor cost method.

10. It is a sum/ total of income received by all ) factors of production.

11. In this method national income is R + W + I + P + MI + (X – M)

12. It is a method in which the total expenditure incurred by the society in a particular year is added together.

13. To avoid double counting these goods and services not considered while counting NI.

Answers:

- Gross Domestic Product (GDP)

- Net National Product (NNP)

- Two sector economy

- National Income (NI)

- Net income from abroad (X – M)

- Central Statistical Organization (CSO)

- Final Goods Approach

- Value Added Approach

- Income method

- Income method

- Income method

- Expenditure Method

- Intermediate goods

(D) Find the odd word out.

1. Members of NIC (National Income Committee) :

Prof. P.C. Mahalanobis, Prof.D.R. Gadgil, Dr .V.K.R.V. Rao, Kaushik Basu.

Answer:

Kaushik Basu2. Features of NI:

Marco economic concept, Money value, Static concept, Flow concept.

Answer:

Static concept3. Three sector economy :

Foreign sectors, Household, Business Firms, Government sector.

Answer:

Foreign sector

4. Concepts of NI:

GDP, NDP, NIC, GNP.

Answer:

NIC

5. Concept of Green GNP :

Sustainable economic development, equitable distribution of benefits, Promotes economic welfare, environmental degradation.

Answer:

Environmental degradation

6. Methods of measurement of NI:

Output method, Point method, Income method, Expenditure method.

Answer:

Point Method

7. In India output is applied to :

agriculture, mining and manufacturing, transport, handicrafts.

Answer:

transport

8. In India output is not applied for :

agriculture, transport, commerce, communication.

Answer:

agriculture

9. Income method excludes :

transfer income, unpaid services, revenue from direct taxes, imputed value of production kept for self-consumption.

Answer:

imputed value of production kept for self-consumption

10. Expenditure method consist of: Consumption expenditure, Investment expenditure, Government expenditure, Expenditure on raw material.

Answer:

Expenditure on raw material

11. Income method is used in :

USA, UK, Germany, India.

Answer:

India

12. Theoretical Difficulties :

Income of foreign firms, Valuation of inventories, Valuation of government services, Transfer income.

Answer:

Valuation of inventories

![]()

13. Practical difficulties :

Capital gain/loss, Depreciation, Problem of double counting, Illegal income.

Answer:

Illegal income

14. To obtain NI, these should be excluded : Sales tax, Direct tax, Subsidies, Indirect tax

Answer:

Subsidies

15. Transfer income is :

Pension, Gifts, Rent, Unemployment ( allowance.

Rent

(E) Complete the following statements.

1. National income is the net aggregate value which does not include …………….

Answer:

depreciation

2. In India, the financial year from 1st April to 31st March is used to express …………….

Answer:

National Income

3. Inclusion of value of intermediate goods leads to …………….

Answer:

double counting

4. Services of housewives are known as …………….

Answer:

unpaid services

5. In India, the calculation of NI is done by …………….

Answer:

Central Statistical Organisation

6. ……………. method is rarely used to calculate NI.

Answer:

Expenditure Method

7. National income is studied by ……………..

Answer:

Macro economists

8. ……………. refers to wear and tear of capital assets.

Answer:

Depreciation

9. In NI value of unpaid services are …………….

Answer:

ignored / excluded

10. ……………. approach is used to avoid double counting.

Answer:

Value added approach

11. The value of only final goods and services produced in primary, secondary and tertiary sector are included in …………….

Answer:

Final goods approach

12. ……………. sector includes exchange activities without the use of money.

Answer:

Non monetised sector

13. Due to lack of occupational specialization, the calculation of national income becomes difficult by ……………. method.

Answer:

the Output Method

14. Estimating the exact national income due to changing price level is ……………. difficulty.

Answer:

(17) theoretical difficulty

15. The expenditure incurred on law and order, defence, education, etc. is called as …………….

Answer:

Government Consumption expenditure

16. While estimating NI, expenditure on final goods and services, subsidies should be …………….

Answer:

(19) included

17. ……………. leads to overestimation of the national income.

Answer:

Double counting

(F) Choose the wrong pair :

I.

| Group ‘A’ | Group ‘B’ |

| Transfer income | pension/ gifts |

| National Income | flow concept |

| Gross Domestic Product (GDP) | C + I + G + (X – M) + (R-P) |

| CSO | Estimation of NI |

Answer:

Wrong pair : Gross Domestic Product C+I+G+(X-M) +(R-P)

II.

| Group ‘A’ | Group ‘B’ |

| National Income | Money value of goods and services |

| Unemployment allowances | Transfer payment |

| NNP | GNP – Depreciation |

| Income Method | Output method |

Answer:

Wrong pair method : Income Method – Output

III.

| Group ‘A’ | Group ‘B’ |

| The Output method | Product method |

| India used | Expenditure method |

| USA, UK | Income method |

| Illegal Income | Theoretical difficulty |

Answer:

Wrong pair : India used – Expenditure method

![]()

(G) Choose the correct pair

I.

| Group ‘A’ | Group ‘B’ |

| Three sector economy | Households, business firms, foreign sector |

| National income | Money value of final goods and services |

| Output method | Income method |

| NNP | GDP – Depreciation |

Answer:

(2) National Income – Money value of final goods and services.

II.

| Group ‘A’ | Group ‘B’ |

| Expenditure Method | Inventory method |

| GDP | C + I + G + (X-M) + (R-P) |

| National income | Micro economic concept |

| Unpaid services | Services of housewife |

Answer:

(4) Unpaid services – Services of housewife

III.

| Group ‘A’ | Group ‘B’ |

| Output method | The final goods approach |

| Income method | Product method |

| Expenditure method | NI = C + I + G |

| Illegal income | income from taxes |

Answer:

(1) Output method The final goods approach.

IV.

| Group ‘A’ | Group ‘B’ |

| National Income Committee | 1956 |

| Financial year | 1st April to 31st March |

| Income Method | NI = Rent + Wages + Interest + Profit + MI + (X-M) |

| Expenditure Method | NI + C + I + G + (X – M) |

Answer:

(3) Income Method – NI = Rent + Wages + Interest + Profit + MI + (X – M)

(H) Assertion and Reasoning

Question 1.

Assertion (A) – National dividend is that part of objective income of the community including of course income derived from abroad which can be measured in money. Reasoning (R) – This is given by Prof. A. C. Pigou.

(1) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

Question 2.

Assertion (A) – National income is the micro economic concept.

Reasoning (R) – Micro economics deals with aggregate.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(iv) (A) and (R) both are false.

Question 3.

Assertion (A) – National income is the flow concept.

Reasoning (R) – It considers the production of goods and services in the economy during a year.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

Question 4.

Assertion (A) – In two sector model money flows from the firms to the households in the form of rent, wages, interest.

Reasoning (R) – Households purchase goods and services from firms by using this money.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

Question 5.

Assertion (A) – NDP = GDP – Deprecation

Reasoning (R) – To get exact value of goods and services depreciation is deducted.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

Question 6.

Assertion (A) – In output method value of final goods and services is considered.

Reasoning (R) – In output method value of intermediate goods also considered.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(iii) (A) is true but (R) is false.

Question 7.

Assertion (A) – Value added approach is the difference between the value of final output and inputs at each stage of production.

Reasoning (R) – To avoid double counting value added approach is used.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

Question 8.

Assertion (A) – While estimating NI indirect taxes included in the market prices are to be deducted.

Reasoning (R) – Indirect taxes are deducted to get accurate estimation of NI.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

Question 9.

Assertion (A) – Output method is more reliable.

Reasoning (R) – It is used in all developed countries.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the } correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(iv) (A) and (R) both are false.

![]()

Question 10.

Assertion (A) – All unpaid services are ) excluded from NI.

Reasoning (R) – It’s difficult to get exact) value of unpaid services.

(i) Both (A) and (R) are true and (R) is the l correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(i) Both (A) and (R) are true and (R) is the l correct explanation of (A).

Question 11.

Assertion (A) – There are no uniform, common standard rates of depreciation

applicable to the various capital assets.

Reasoning (R) – It is easy to make correct deduction for deprecation.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(iii) (A) is true but (R) is false.

Question 12.

Assertion (A) – The small producers do not keep an account of their production. Reasoning (R) – Most of the small producers are ignorant and illiterate.

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

(ii) Both (A) and (R) are true but (R) is not the correct explanation of (A).

(iii) (A) is true but (R) is false.

(iv) (A) and (R) both are false.

Answer:

(i) Both (A) and (R) are true and (R) is the correct explanation of (A).

2 [A]. Identify and Explain the following concepts:

Question 1.

Suman is a math teacher by profession She also taught her son math at home.

Answer:

Concept: Unpaid services

Explanation : The services provided out of love, affection, mercy, sympathy and charity ( are not included in NI as they are not paid { (12) for. The value of unpaid services is not counted in NI.

Thus, Suman teaching math to her son is treated as unpaid service.

Question 2.

Renu paid ₹ 500 for her chest *X’ ray in $ private hospital and for the same ‘X’ ray she paid ₹ 50 in government hospital.

Answer:

Concept: Valuation of government services.

Explanation : The government provides various services lower than market price. So it is difficult to get real value of these while estimating NI.

Question 3.

Anil is a graduate but he is unemployed and receives ₹ 600 from the government.

Answer:

Concept: Unemployment Allowances. Explanation : It is considered as a transfer payment which is not included in NI.

Question 4.

Reena studies in government medical college and pays annual fees of ₹ 80,000 per year and Meena who studies in private medical college and pays annual fees of ₹ 8,00,000.

Answer:

Concept: Valuation of government services.

Explanation : The government provides various services lower than market price. It is difficult to get real value of such services while estimating NI.

Question 5.

Pooja, a cook earns ₹ 8,000 per month and she also cooks food in her house.

Answer:

Concept: Unpaid services.

Explanation : The services provided out of love, affection, mercy, sympathy and charity are not included in NI as they are not paid for. The value of unpaid services is not counted in NI.

Question 6.

Suresh regularly purchases sanitizer for ₹ 60, owing to the ‘Corona virus’ outbreak, it disappeared from the market and after few days it was sold at ₹ 100.

Answer:

Concept: Illegal income (Black Marketing)

Explanation: Illegal income is not included in NI. There will be underestimation of NI as income from illegal activities are not included.

Question 7.

To increases the production, Ambhuja cement recently purchased the machinery worth ₹ 2000 crores.

Answer:

Concept: Private Investment expenditure (I).

Explanation : It is the investment made by private businessman on capital goods like machinery, technology, plants, etc.

Question 8.

Rahul bought a car on June, 2020 from his friend Rajesh for 1 1,20,000 which is manufactured in

Answer:

Concept: Second hand goods.

Explanation : Expenditure on second hand goods should be excluded from NI. Such goods were accounted for in the year when it was produced and sold.

![]()

Question 9.

India incurred ₹ 40,000 crores to purchase missile systems S-400 from Russia.

Answer:

Concept : The Government’s Consumption expenditure.

Explanation : Government Consumption expenditure refers to the expenditure incurred by the government on various administrative services like, law and order, defence, education, health, etc.

Such government expenditures are included while calculating National Income by expenditure method.

Question 10.

The government of India is incurring ₹ 1600 crore on Delhi-Mumbai expressway which will complete by 2023 of the economy.

Answer:

Concept : The Governments Investments expenditure.

Explanation : Government Investment expenditure refers to the expenditure incurred by the government on creating infrastructural facilities like construction of roads, railways, bridges, dams, canals, etc. Such government expenditures are included while calculating National Income by expenditure method.

(B) Distinguish between

Question 1.

Gross National Product (GNP) and Gross Domestic Product (GDP).

Answer:

Gross National Product (GNP):

- Gross National Product refers to gross money value of all final goods and services produced in the country during one accounting year, including net income from abroad.

- GNP = C + I + G + (X – M) + (R – P)

- GNP includes income earned by Indian Nationals within or outside the country.

Gross Domestic Product (GDP):

- Gross Domestic Product refers to gross money value of all final goods and services produced within the domestic boundaries of a country during one accounting year.

- GDP = C + I + G + (X-M)

- GDP does not include income earned by Indian national outside the country.

Question 2.

Net National Product (NNP) and Net Domestic Product (NDP).

Answer:

Net National Product (NNP):

- NNP is the net value of all final goods and services produced in an economy for one accounting year. It includes income from abroad.

- It includes income earned by Indian Nationals within and outside the country.

- NNP = C + I + G + (X – M) + (R – P) – Depreciation

- NNP will be greater than NDP if (R – P) is positive.

Net Domestic Product (NDP):

- NDP is net value of all final goods and services produced within the domestic boundaries of the country.

- It does not include income earned by the Indian Nationals outside the country.

- NDP = C + I + G + (X-M)- Depreciation

- NDP will be less than NNP if (R – P) is positive and it can be more than NNP if (R – P) is negative.

Question 3.

Output Method Or Product Method and Income Method Or Factor Cost.

Answer:

Output Method Or Product Method:

- According to the product or output method, National Income is estimated by adding up the value of all final goods and services produced in the country during one year.

- NI = C+I+G+(X-M)+(R – P) – Depreciation – Income Tax + Subsidies

- In India, this method is applied to agriculture, mining and manufacturing.

- Here we look at National Income from production side.

- In this method we deduct indirect tax and then add subsidies to arrive at National Income at Factor Cost from Market Price.

Income Method Or Factor Cost:

- According to Income method the National Income is estimated by adding the factor Incomes that accrue to factors of production by way of rent, wages, interest and profit.

- NI = R + W + I + P + MI + (X-M) + (R-P) – Depreciation – Transfer Income.

- In India this method is used by National Income Committee in trade, transport, professionals, liberal arts, public administration.

- Here we look at National Income from distribution side.

- This method is a direct method as we arrive at National Income at factor cost.

Question 4.

Gross National Product (GNP) and Net National Product (NNP). (Feb. ‘16; Oct. ‘15)

Answer:

Gross National Product (GNP):

- Gross National Product refers to gross money value of all final goods and services produced in an economy during a year. It includes net income from abroad.

- Depreciation cost of capital assets are included.

- GNP = C + I + G + (X-M) + (R-P)Or GNP = NNP + Depreciation

- GNP value does not give us a true picture of the net increase in the production of the economy.

- It is a wider concept. It includes NNP.

- GNP will be greater than NNP.

Net National Product (NNP)

- Net National Product refers to the net money value of all goods and services produced in an economy during a year. It includes net income from abroad.

- Depreciation cost of capital assets are not included.

- NNP = GNP – Depreciation Or

NNP = C + I + G + (X-M) + (R – P) – Depreciation - NNP is a better measure of National Income. It is a better index of judging the progress of the economy at any time.

- It is narrow concept. It is a part of GNP.

- NNP will be less than GNP.

![]()

Question 5.

Illegal Income and Transfer Income.

Answer:

Illegal Income:

- Illegal income means income which is earn from illegal activities.

- E.g. Income from gambling, black marketing, theft, smuggling, etc.

Transfer Income:

- Transfer income means money from the government in the form of benefits.

- E.g. income from pension, gift, unemployment allowance, etc.

Question 6.

Two Sector economy and Three Sector economy.

Answer:

Two Sector economy:

- In this economy flow of goods and money is circulated in households and business firms.

- Symbolically – Y = C + I

Three Sector economy:

- In this economy flow of goods and money is circulated in households, business firms and government sector.

- Symbolically – Y= C + I + G.

Question 7.

Three Sector economy and Four Sector economy.

Answer:

Three Sector economy:

- In this economy, flow of goods and money is circulated in households, business firms and government sector.

- Symbolically – Y = C + I + G

Four Sector economy:

- In this economy, flow of goods and money is circulated in households, business firms, government sector and foreign sector.

- Symbolically – Y= C + I + G + (X-M)

Question 8.

Income Method and Expenditure Method.

Answer:

Income Method:

- It is the sum of income earn by all factors of production in a year.

- In this method, national income is estimated from the distribution side

- Symbolically – NI = R + W + I + MI + (X-M)

- This method is extremely popular in developed countries.

Expenditure Method:

- It is the sum of expenditure incurred by private sector and government on consumption and investment in a year.

- In this method, national income is estimated from the expenditure side.

- Symbolically -NI = C + I + G + (X-M) + (R-P)

- This method is very rarely used by any country.

Question 9.

Closed Economy and Open Economy.

Answer:

Closed Economy:

- It is an economy which is not open to international trade and foreign investment.

- In a closed economy only the values of goods and services produced within the country are considered in the N.I. estimate.

- Net exports and net factor income from abroad are not included.

- GNP = GDP + C + I + G.

Open Economy:

- It is an economy which is open to international trade and foreign investment.

- In an open economy the values of goods and services produced within the country as well as net exports and net factor income from abroad are also considered in N.I. estimate.

- Net exports and net factor income from abroad are included.

- GDP(MP) = C + I + G + (X – M)

GNP(MP) = GDP + (R – P)

= C + I + 0 + (X – M) + (R – P)

Question 10.

Product / Output Method and Expenditure Method.

Answer:

Output Method Or Product Method:

- According to the product or output method, National Income is estimated by adding up the value of all final goods and services produced in the country during one year.

- NI = C+I+G+(X-M)+(R – P) – Depreciation – Income Tax + Subsidies

- In India, this method is applied to agriculture, mining and manufacturing.

- Here we look at National Income from production side.

- In this method we deduct indirect tax and then add subsidies to arrive at National Income at Factor Cost from Market Price.

Expenditure Method:

- It is the sum of expenditure incurred by private sector and government on consumption and investment in a year.

- In this method, national income is estimated from the expenditure side.

- Symbolically -NI = C + I + G + (X-M) + (R-P)

- This method is very rarely used by any country.

![]()

3. Answer the following questions:

Question 1.

Explain the income method of measuring National Income.

Answer:

Meaning:

In general sense of the term ‘National Income’ refers to the total money value of all final goods and services produced in the country during a period, usually one year. It includes net income from abroad. But does not include depreciation.

Definitions:

- Prof. AC. Pigou: ‘The national dividend is that part of the objective income of the community including of course income derived from abroad, which can be measured in money.”

- Prof. Irving Fisher: “National dividend or income consists solely of services as received by ultimate consumers whether from their material or from their human environments.”

- National Income Committee: “A National Income estimate measures the volume of commodities and services turned out during a given period counted without duplication.” Here, the National Income is calculated without double counting.

Question 2.

Explain the expenditure method of measuring National Income.

Answer:

(B) Expenditure Method :

This method also known as outlay method. NI = C + I + G + (X – M) + (R – P)

National Income can also be calculated by adding up the expenditure incurred on purchase of final goods and services. We can get National Income by summing up all consumption expenditure, investment expenditure made by all individuals, firms as well as the government of a country during a year.

- Consumption Expenditure (C) : It includes all expenditure incurred on goods and services by households during the year. It includes expenditure mostly on durable and non-durable goods, which are consumed by the consumers. E.g. food, medical care, clothing, car, computer and services, etc.

- Investment Expenditure (I) : It refers to the investment made by private businessman on capital goods like machinery, plants, factories, warehouses, etc.

- Government Expenditure on goods and services (G) : Government expenditure refers to expenditure on consumption and investment –

- Consumption expenditure : It refers to expenditure incurred on various administrative services like law and order, defence education, generation and distribution of electricity.

- Investment expenditure : It refers to expenditure incurred by government on construction of roads, railways, dams, canals, etc.

- Net Exports (X – M): It refers to difference between exports and imports of the country. If the exports are more than imports then net exports will be positive, it is called Trade Surplus and if imports are greater than exports, the net exports will be negative, it is called as Trade Deficit.

- Net Receipts (R-P) : It is the difference between expenditure incurred by foreigners in the country (R) and expenditure incurred abroad by Nationals (P). Net Receipts can also be Positive or Negative.

Net National Expenditure = NNE = C + I + G + (X – M) + (R – P) – Depreciation. NNPFC or NI = C + I + G + (X -M) + (R -P) “Depreciation “ Indirect Tax + Subsidies.

Precautions :

The following precautions should be taken while estimating National Income.

- To avoid double counting take the expenditure incurred only on final goods and services.

- Government expenditure on transfer payments to be excluded like unemployment allowances, old age pension etc.

- Expenditure on second hand goods like furniture, house, land and financial assets { like shares, bonds, etc. should be excluded.

- Exclude expenditure incurred on purchase of financial assets such as shares, bonds, etc.

- Deduct indirect tax and add subsidies. Out of these methods, output method and income method are extensively used. Expenditure method is rarely used because of its practical difficulties.

In India, the Central Statistical Organisation (CSO) adopts a combination of output method and income method to estimate N.I. of India.

Question 3.

Give the definitions of National Income.

Answer:

Meaning:

In general sense of the term ‘National Income’ refers to the total money value of all final goods and services produced in the country during a period, usually one year. It includes net income from abroad. But does not include depreciation.

Definitions:

- Prof. AC. Pigou: ‘The national dividend is that part of the objective income of the community including of course income derived from abroad, which can be measured in money.”

- Prof. Irving Fisher: “National dividend or income consists solely of services as received by ultimate consumers whether from their material or from their human environments.”

- National Income Committee: “A National Income estimate measures the volume of commodities and services turned out during a given period counted without duplication.” Here, the National Income is calculated without double counting.

4. State with reasons whether you agree or disagree with the following statements:

Question 1.

National Income is important to formulate only economic policies.

Answer:

No, I do not agree with this statement.

National Income data is important for many other purposes, like –

- For the Economy : National Income data are very important for marco economic analysis and performance of the economy.

- Economic Planning: The data of National Income is very important tools for long term and short term economic planning.

- Economic Research: The data of National [ Income is very useful to the research students to study aggregate consumption expenditure, investment expenditure, etc.

- Speed of Economic Growth : National Income makes it possible to know the trends or speed of the economic growth of our ( country in relation to previous years.

![]()

Question 2.

Income from second hand sale of goods is excluded from National Income.

Answer:

Yes, I agree with this statement.

- National Income includes only the money value of final goods and services produced in ( the current year.

- Income from sale and purchase of second hand goods is not included in National Income because these goods are not a part of current years production. Their value was included in the National Income of that year in which they were produced.

- As the wealth of the country remains the same if they are included in the current years National Income it will lead to double counting.

- So, National Income figures will get inflated due to over estimation.

Question 3.

National Income at factor cost includes subsidy.

Answer:

Yes, I agree with this statement.

- National Income at factor cost is the income earned by the factor owners (landlord, labourer, capitalist) in the course of contributing to the country’s output.

- NI(FC) = C + I + G + (X – M)+ (R – P) – Depreciation – Indirect Tax + Subsidies

- Subsidies is a negative tax. It is a sought of concession or discount given by the government to the consumers and producers.

- Subsidies are paid by the government to the firms / producers.

- Also the goods are sold at a price lower than their cost.

- Subsidies reduce the price of product below the factor cost. So to arrive at N.I. at factor cost we add subsidies.

Question 4.

National Income estimates are not accurate in India.

Answer:

Yes, I agree with this statement.

There are many statistical difficulties faced in the estimation of National Income due to which N.I. estimates are not accurate. They are as follows :

- There is the danger of double counting by including the value of intermediate goods.

- Inadequate and unreliable information regarding income and expenditure leads to inaccuracy in estimating N.I.

- In India, people are illiterate and ignorant, so they do not maintain proper accounts.

- To evade tax people do not reveal their exact income.

- The sources from which data are obtained are not absolutely reliable.

- Statistical staff are untrained and inefficient.

Question 5.

Old age pension is transfer income.

Answer:

Yes, I agree with this statement.

- Transfer Income are income received by individuals without contributing anything to the current years production of goods and services. It is a flow of money without a reverse flow of goods or services.

- Old age pension is received by a person after he retires from work.

- To get this income tlje person actually does not contribute anything to production of goods and services during that period.

- Old age pension is income transferred from the government.

- So it is a government expenditure.

- Transfer income are included in personal income. But they are not included in National Income because such payments do not result in any addition to the total production of goods.

Question 6.

Paid services are included in National Income.

OR Unpaid services are not included in National Income. (Mar. ‘15; Oct. ‘15)

Answer:

Yes, I agree with this statement.

- In economic sense paid services refer to economic production which means they are production of those goods and services which are meant for sale and have market value.

- Paid services are marketable. They have exchange value. We can determine its price and so it can be included in National Income.

- Unpaid services cannot be marketed so they cannot be included in National Income. Although these services contribute to human welfare.

- E.g. service of housewife. It is non-economic production, which is not marketable.

- National Income is the sum of money value of all goods and services produced during the year by the resources of a country.

Question 7.

National Income is an important tool to measure the overall performance of the economy.

OR

The concept of National Income has an important place in Economic development.

Answer:

Yes, I agree with this statement.

- National Income is one of the important indicators of economic growth and development.

- National Income is a macro variable that represents the economy as a whole.

- When there is an increase in National Income it indicates that the country’s production of goods and services have increased, employment increases, trade with rest of the world increases.

- When National Income of a country increases at a higher rate than the rate of increase in population, it leads to improvement in the standard of living and welfare of the people.

- The Per Capita Income also increases when National Income increases.

- Therefore, National Income is an important tool to measure the overall performance of the economy.

Question 8.

The services of housewife (unpaid services) is included in National Income.

Answer:

No, I do not agree with this statement.

OR

Services of housewives are excluded from National Income.

Answer:

Yes, I agree with this statement.

- The National Income is the sum of money value of all goods and services produced during the year by the resources of a country.

- But the goods and services which do not have exchange value or market value are not included in National Income as they are non-economic production.

- Service of housewife is not considered an economic activity as it is non – economic production and so it does not have exchange value or market value.

- Housewife is not paid by family members.

- Therefore, the service of housewife is not included in National Income but the service of a maid servant is included.

Question 9.

Illegal income is not included in National Income.

Answer:

Yes, I agree with this statement.

- The existence of a parallel or black economy is a common feature of most of the economies.

- Productive activities in this sector are either concealed or under reported and as a result the income generated remain unreported. It is rather difficult to estimate this income correctly. So they are not included in National Income.

- For example income originating from activities as smuggling, black-marketing, gambling, selling harmful drugs, etc. are excluded from National,Income.

- Many rich people, businessmen and landlords hide their property and wealth. No authorised registration is available for the income received so they are not included.

Question 10.

Transfer income is included in National Income.

Answer:

No, I do not agree with this statement.

OR

Transfer Income cannot be included in National Income.

Answer:

Yes, I agree with this statement.

- Transfer income is income received by individuals without contributing to the current years production of goods and services.

- Transfer income received by people in the form of old age pension, gifts, lottery prize etc. are not included in National Income.

- These incomes are included in Personal Income but not in National Income.

- All transfer income are actually earned by some other people, by contributing to production originally and then transferred to another.

- If such incomes are counted at both places two times, there will be a double counting.

- Therefore, to avoid double counting and to get accurate estimation, transfer incomes are not included in National Income.

National Income includes only income from production of goods and services.

![]()

Question 11.

National Income is a stock / reserve concept.

Answer:

No, I do not agree with this statement.

OR

National Income is not a stock. It is a flow concept.

Answer:

Yes, I agree with this statement.

- National income is a flow concept.

- National income is expressed per year.

- National income refers to money value of all goods and services produced by the economy in a year.

- It considers the production of current year and not previous year.

5. Study the following table / figures / passages and answers :

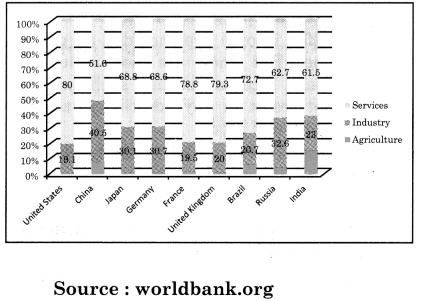

1. Subdivided Bar Diagram

Diagram 1 : Share of GDP by Sector for Selected Nations (2017)

Question 1.

Which are the sectors contributing in National Income / GDP?

Answer:

There are three sectors contributing in GDP – agriculture, industry and tertiary (services) sector.

Question 2.

In the United States GDP, which sectors contribution is maximum and how much percent?

Answer:

The service (tertiary) sector’s contribution is maximum in United States GDP. It was 80%.

Question 3.

In which country, contribution of primary ‘ sector (agriculture) is lowest in GDP?

Answer:

UK (United Kingdom) and Germany’s; contribution of primary sector is lowest in GDP.

Question 4.

How much is the share of agriculture in India’s National Income in the year 2017?

Answer:

In the year 2017, the share of agriculture was 15.5%.

Question 5.

In which country, the share of industry is maximum and how much percent?

Answer:

In China, the share of industry is maximum. It is 40.5%.

Question 6.

Give your opinion on sectorwise contribution in India’s GDP.

Answer:

In India, share of agriculture sector is quite high as compared to developed countries. There is need to reduce the share of agriculture in GDP. The industry and service sector should be developed so their contribution in the GDP will rise.

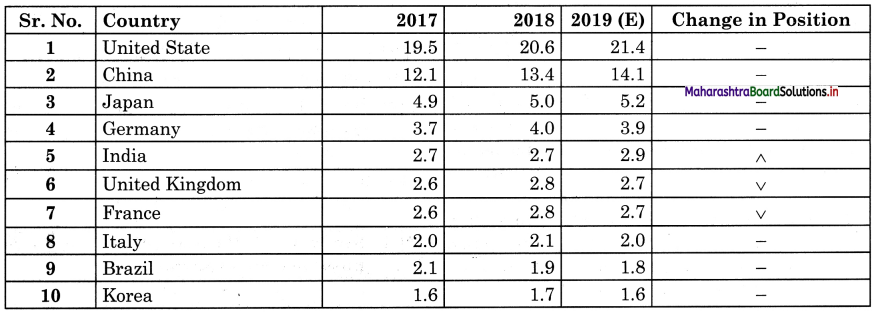

2. Top 10 Economies in the world in terms of GDP at current US $ trillion.

Data Source : World Economic Outlook, October 2019 database

Note : IMF’s estimate, A indicates improvement in rank, v indicates drop in rank and – indicates unchanged rank

Question 1.

Which country has highest GDP in the world?

Answer:

United State of America has the highest GDP in the world.

Question 2.

Which country has the least GDP in the world?

Answer:

Korea has the least GDP in the world.

Question 3.

At what position does India stand with respect to GDP rates?

Answer:

India stands at 5th position with respect to ) GDP rates.

Question 4.

Find out the difference in China’s GDP in the year 2017 and 2018.

Answer:

The China’s GDP has increased by 1.3 US $ trillion in the year 2018 as compared to the year 2017.

Question 5.

By how much India’s GDP has increased in the year 2017-2018.

Answer:

There is no increase in India’s GDP in the year 2017-18. India’s GDP is constant.

Question 6.

Given your opinion on India’s GDP.

Answer:

India’s is a developing economy, but it still stands at the 5th position in the worlds GDP’s.

India should focus on increasing the production of goods and services specially

from secondary and tertiary sector which will help to increase the GDP.

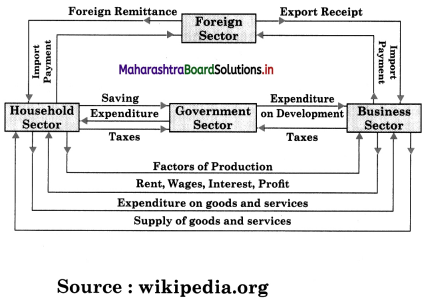

(3) Circular Flow of Income.

Question 1.

What does this diagram represent?

Answer:

This diagram represents model of four sector economy.

Question 2.

Which sectors are included in this type of economy?

Answer:

It includes households, firms, government and foreign sector.

Question 3.

What role does the government play in this economy?

Answer:

The government is playing very important ) role by incurring expenditure on consumption and investment. The government is also S collecting tax from household, business firm and through import.

Question 4.

Give your opinion on overseas or foreign sector.

Answer:

In four sector economy, foreign sector is playing important role. This is known as open economy which helps to earn foreign exchange, promote economic development, availability of imported goods, etc.

![]()

6. Answer in detail;

Question 1.

What is national income? Explain theoretical conceptual difficulties in the calculation of national income.

Answer:

National income means money value of goods and services produced in the country in a year.

According to National Income committee:

“A national income estimate, measures the volume of goods and services turned out during a given period without duplication. There are many practical difficulties in the measurement of NI.

- Transfer payment: If it included in national income then there will be overestimation of NI. E.g. pension, gifts, unemployment allowances, etc. are excluded.

- Unpaid services : The value of unpaid services are not included in national income as they are not paid for. E.g. services of housewife.

- Illegal income : The income from illegal activities are not included in NI. E.g. black marketing, smuggling.

- Production for self-consumption: It is very difficult to get data and value of goods kept for self-consumption as they do not enter market.

- Income of foreign firms : Income of foreign firm should be included in the national income of the country where the firm undertakes production work. But the profit earn by these firms are transferred to their home own country.

Question 2.

Explain the difficulties in measuring National Income.

Answer:

National income means money value of goods and services produced in the country in a year.

According to National Income committee:

“A national income estimate, measures the volume of goods and services turned out during a given period without duplication. There are many practical difficulties in the measurement of NI.

(A) Theoretical difficulties

- Transfer payment: If it included in national income then there will be overestimation of NI. E.g. pension, gifts, unemployment allowances, etc. are excluded.

- Unpaid services : The value of unpaid services are not included in national income as they are not paid for. E.g. services of housewife.

- Illegal income : The income from illegal activities are not included in NI. E.g. black marketing, smuggling.

- Production for self-consumption: It is very difficult to get data and value of goods kept for self-consumption as they do not enter market.

- Income of foreign firms : Income of foreign firm should be included in the national income of the country where the firm undertakes production work. But the profit earn by these firms are transferred to their home own country.

(B) Practical Difficulties or Statistical Difficulties:

- Problem of double counting: In case of certain goods it is difficult to distinguish properly between final goods and intermediate goods. That’s why problem of double counting arises e.g. flour is final goods for housewife, but it is intermediate goods for the bakery.

- Existence of non-monetised sector: In India large non-monetised sector exists in rural area specially in agriculture. In agriculture, many places goods and services are exchanged with goods that’s why it is difficult to count in national income.

- Inadequate and unreliable data: Because of illiteracy it is difficult to get adequate and reliable data from unorganised sector, small enterprises, agriculture, etc.

- Depreciation: Its difficult to measure exact value of depreciation. There are no uniform common accepted standard rates of depreciation applicable to the various capital assets.

- Capital gain or loss: Due to capital gain there is overestimation and due to capital loss there is underestimation of national income.

- Illiteracy and ignorance: Majority of small producer in developing counties are illiterate and ignorant and are not able to keep accounts of their productive activities.

- Lack of systematic, occupational classification: There is lack of systematic occupational classification, which makes the calculation of national income difficult. Especially in rural areas where many villagers work on farms for some time and also take some other job during offseason.

- Untrained and incompetent staff: Due to untrained and incompetent staff, accurate and timely, information cannot be obtained.

Question 3.

What is National Income? Explain the Output method of measuring National Income.

Answer:

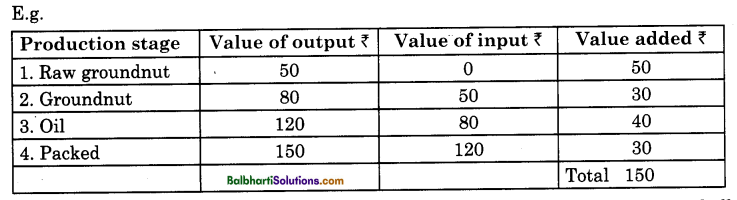

Product Method or Output Method: This method is also called as Inventory Method.

According to this method economy is divided into various sectors like agriculture, mining, manufacturing, small enterprises, commerce, transport, communication, etc.

National income by this method can be calculated by either valuing all final goods and services

produced during a year at their market price or by adding up all values at each higher stage of

production, until these products are turned into final products.

In output method there are two approaches to measure national income.

(1) Final Goods Approach I Final Product Approach : According to this approach, value of all final goods and services produced in primary, secondary and tertiary sector are included and the value of all intermediate transactions are ignored.

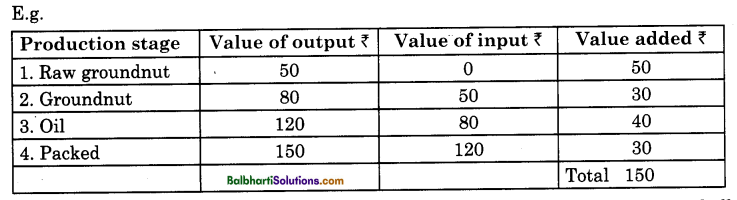

2. Value Added Approach I Value Added Method: To avoid double-counting, the value-added approach is used to estimate the National Income. According to this method, it is necessary to obtain the total of value-added at each stage in the manufacture of a commodity to arrive at Gross National Product. The value-added method can be explained by means of a simple example.

(a) In the above example, value of groundnut with shell is 50, after removing shells value of groundnut is 80, after crushing groundnut the value is 120 and when oil is packed in the packets its value is 150.

To avoid double-counting either the value of final output or the value – added should be taken in estimation of National Income.

The output method is widely used in the underdeveloped countries. In India, this method is applied in agriculture, mining and manufacturing sector.

Precautions:

- Avoid Double Counting: The value of only final goods and services must be considered and not the value of raw – materials or intermediary goods, etc.

- Self Consumption Goods: Goods used for self-consumption by farmers should be included in National Income.

- Price Level Changes to be considered: The values of national output must be expressed in terms of prices in some base year to know the national output in real terms i.e. N.I. at constant price.

- Net Income from Abroad: Care should be taken to include net income from abroad in National Income.

- Depreciation: Depreciation of capital assets should be deducted from the value of gross investment during the year.

- Indirect Taxes and Subsidies: To get National Income, deduct the indirect tax from the market price and add subsidies.

- Second-Hand Goods: Sale and purchase of second-hand goods should be ignored as it is not a part of current production.

Question 4.

Explain the various method of measuring National Income. ?

Answer:

National Income is macro economic concept. National Income means money value of goods and services produced in the country in a year. There are three methods to measure national income.

(1) The Output Method,

(2) The Income Method,

(3) The Expenditure Method.

(A) The Income Method : This method is also known as factor cost method. According to this method national income is the sum of income received by all factors of production in a year. So national income is the income received by all the citizens of the country in a year. In income method national income studied from the distribution side. According to income method national income or GNP is

NI = R + W + I + P + MI + (X – M)

- Rent (R) : Rent and Royalty is usually treated as the payment for the land, building, machines that are rented.

- Wages (W) : It includes wages and salaries earned by labour as well as it includes commission, bonus, social security payments, fringe benefits, etc.

- Interest (I) : Interest is the payment for using the services of capital. It includes interest paid by banks, insurance companies etc.

- Profit (P) : It includes the profit of private and public sector companies.

- Mixed Income (MI) : It is the income which is earned by self-employed. They earn income through various sources like wages for effort put, rent on own property, interest on own capital, etc.

- Net Exports (X – M) : It is the difference between export and imports.

Precautions :

- Transfer payment : It should not be included in national income. E.g. pension, gifts, unemployment allowances, lottery prize, etc.

- Unpaid services : It should not be included in national income. E.g. services of housewife, teacher teaching her own child, etc.

- Second hand goods : The income from sale of second hand goods should not be included.

- Financial asset : The income from sale of shares and bonds should not be included in national income.

- Tax revenue : The revenue of government through taxes should not be included in national income.

- Undistributed profits of companies, income from government property and profits from public enterprise should be included.

- Imputed value of production kept for self consumption and rental value of owner occupied houses should be included in national income.

(B) Expenditure Method :

This method also known as outlay method. NI = C + I + G + (X – M) + (R – P)

National Income can also be calculated by adding up the expenditure incurred on purchase of final goods and services. We can get National Income by summing up all consumption expenditure, investment expenditure made by all individuals, firms as well as the government of a country during a year.

- Consumption Expenditure (C) : It includes all expenditure incurred on goods and services by households during the year. It includes expenditure mostly on durable and non-durable goods, which are consumed by the consumers. E.g. food, medical care, clothing, car, computer and services, etc.

- Investment Expenditure (I) : It refers to the investment made by private businessman on capital goods like machinery, plants, factories, warehouses, etc.

- Government Expenditure on goods and services (G) : Government expenditure refers to expenditure on consumption and investment –

- Consumption expenditure : It refers to expenditure incurred on various administrative services like law and order, defence education, generation and distribution of electricity.

- Investment expenditure : It refers to expenditure incurred by government on construction of roads, railways, dams, canals, etc.

- Net Exports (X – M): It refers to difference between exports and imports of the country. If the exports are more than imports then net exports will be positive, it is called Trade Surplus and if imports are greater than exports, the net exports will be negative, it is called as Trade Deficit.

- Net Receipts (R-P) : It is the difference between expenditure incurred by foreigners in the country (R) and expenditure incurred abroad by Nationals (P). Net Receipts can also be Positive or Negative.

Net National Expenditure = NNE = C + I + G + (X – M) + (R – P) – Depreciation. NNPFC or NI = C + I + G + (X -M) + (R -P) “Depreciation “ Indirect Tax + Subsidies.

Precautions :

The following precautions should be taken while estimating National Income.

- To avoid double counting take the expenditure incurred only on final goods and services.

- Government expenditure on transfer payments to be excluded like unemployment allowances, old age pension etc.

- Expenditure on second hand goods like furniture, house, land and financial assets { like shares, bonds, etc. should be excluded.

- Exclude expenditure incurred on purchase of financial assets such as shares, bonds, etc.

- Deduct indirect tax and add subsidies. Out of these methods, output method and income method are extensively used. Expenditure method is rarely used because of its practical difficulties.

In India, the Central Statistical Organisation (CSO) adopts a combination of output method and income method to estimate N.I. of India.

Product Method or Output Method: This method is also called as Inventory Method.

According to this method economy is divided into various sectors like agriculture, mining, manufacturing, small enterprises, commerce, transport, communication, etc.

National income by this method can be calculated by either valuing all final goods and services

produced during a year at their market price or by adding up all values at each higher stage of

production, until these products are turned into final products.

In output method there are two approaches to measure national income.

(1) Final Goods Approach I Final Product Approach : According to this approach, value of all final goods and services produced in primary, secondary and tertiary sector are included and the value of all intermediate transactions are ignored.

2. Value Added Approach I Value Added Method: To avoid double-counting, the value-added approach is used to estimate the National Income. According to this method, it is necessary to obtain the total of value-added at each stage in the manufacture of a commodity to arrive at Gross National Product. The value-added method can be explained by means of a simple example.

(a) In the above example, value of groundnut with shell is 50, after removing shells value of groundnut is 80, after crushing groundnut the value is 120 and when oil is packed in the packets its value is 150.

To avoid double-counting either the value of final output or the value – added should be taken in estimation of National Income.

![]()

The output method is widely used in the underdeveloped countries. In India, this method is applied in agriculture, mining and manufacturing sector.

Precautions:

- Avoid Double Counting: The value of only final goods and services must be considered and not the value of raw – materials or intermediary goods, etc.

- Self Consumption Goods: Goods used for self-consumption by farmers should be included in National Income.

- Price Level Changes to be considered: The values of national output must be expressed in terms of prices in some base year to know the national output in real terms i.e. N.I. at constant price.

- Net Income from Abroad: Care should be taken to include net income from abroad in National Income.

- Depreciation: Depreciation of capital assets should be deducted from the value of gross investment during the year.

- Indirect Taxes and Subsidies: To get National Income, deduct the indirect tax from the market price and add subsidies.

- Second-Hand Goods: Sale and purchase of second-hand goods should be ignored as it is not a part of current production.