Balbharti Maharashtra State Board Class 12 Secretarial Practice Important Questions Chapter 9 Depository System Important Questions and Answers.

Maharashtra State Board 12th Secretarial Practice Important Questions Chapter 9 Depository System

1A. Select the correct answer from the options given below and rewrite the statements.

Question 1.

Dematerialization removes the problem of _____________ handling of securities.

(a) Physical

(b) Public

(c) Social

Answer:

(a) Physical

Question 2.

The National Securities Depository Limited (NSDL) was established in the year _____________

(a) 1995

(b) 1996

(c) 1997

Answer:

(b) 1996

![]()

Question 3.

The process of converting shares from the electronic form into physical form is called _____________

(a) Rematerialization

(b) Dematerialization

(c) Depository

Answer:

(a) Rematerialisation

Question 4.

An agent of the depository is _____________

(a) Depository Participant (DP)

(b) Depository Officer (DO)

(c) Beneficial Owner (BO)

Answer:

(a) Depository Participant (DP)

Question 5.

An intermediary between the investors and depository is _____________

(a) Depository Participant

(b) SEBI

(c) Chief Executive Officer (CEO)

Answer:

(a) Depository Participant (DP)

Question 6.

An investor has to open _____________ with the Depository Participant for handling shares in electronic form.

(a) Demat A/c

(b) Securities

(c) Depository A/c

Answer:

(a) Demat A/c

![]()

Question 7.

Depository Participant is an agent of _____________

(a) Investor

(b) Securities and Exchange Board of India

(c) Depository

Answer:

(a) Investor

Question 8.

_____________ is a process by which share certificates of investors are converted into an electronic form.

(a) Dematerialization

(b) Rematerialization

(c) Depository

Answer:

(a) Dematerialization

Question 9.

Dematerialization is a process in which share in physical form is converted into _____________

(a) Electronic form

(b) Paper form

(c) Computer form

Answer:

(a) Electronic form

Question 10.

The provisions regarding dematerialization of securities are made in _____________

(a) Law

(b) Memorandum of Articles

(c) Articles of Association

Answer:

(c) Articles of Association

![]()

Question 11.

Demat account holder can _____________ any person of his choice.

(a) Elect

(b) Nominate

(c) Choose

Answer:

(b) Nominate

Question 12.

All depository participants are to be registered with _____________

(a) Registrar of companies

(b) Securities and Exchange Board of India (SEBI)

(c) Depository

Answer:

(b) Securities and Exchange Board of India (SEBI)

Question 13.

An institution which records share certificate in the electronic form is known as _____________

(a) Stock exchange

(b) Depository

(c) Depository Participant

Answer:

(b) Depository

1B. Match the pairs.

Question 1.

| Group ‘A’ | Group ‘B’ |

| (1) Dematerialization | (a) State of being interchangeable |

| (2) Rematerialisation | (b) Register with Depository |

| (3) Fungibility | (c) Demat Request Form |

| (4) Issuer | (d) Transferor informs DP |

| (5) Sale of Shares | (e) Transferee intimates the DP |

| (6) Purchase of Shares | (f) Remat Request Form |

| (g) Broker |

Answer:

| Group ‘A’ | Group ‘B’ |

| (1) Dematerialization | (c) Demat Request Form |

| (2) Rematerialisation | (f) Remat Request Form |

| (3) Fungibility | (a) State of being interchangeable |

| (4) Issuer | (b) Register with Depository |

| (5) Sale of Shares | (d) Transferor informs DP |

| (6) Purchase of Shares | (e) Transferee intimates the DP |

1C. Write a word or a term or a phrase that can substitute each of the following statements.

Question 1.

The year in which the Depository act was passed.

Answer:

1996

Question 2.

The largest institution in India which gives Depository services.

Answer:

NSDL (National Security Depository limited)

![]()

Question 3.

The year in which National Security Depository Limited (NSDL) Started functioning.

Answer:

1996

Question 4.

Investor in whose name Demat account is opened.

Answer:

Beneficial owner (ISIN)

Question 5.

An account to be opened by an investor for handling shares in electronic form.

Answer:

Demat A/c

1D. State whether the following statements are true or false.

Question 1.

CDSL is the oldest Depository in India.

Answer:

False

Question 2.

An investor can keep his Securities with his savings bank account.

Answer:

False

Question 3.

ISIN number is given to the Depository Participant.

Answer:

False

Question 4.

Dealing in Demated Securities is a time-consuming process.

Answer:

True

Question 5.

Settlement of cash is easy in case of rematerialized Securities.

Answer:

False

![]()

Question 6.

For Dematerialized Securities Company has to be registered with the Depository.

Answer:

True

1E. Find the odd one.

Question 1.

Physical, Electronic, Capital

Answer:

Capital

Question 2.

Off Market Trade, Market Trade, Clearing blouse.

Answer:

Clearing House

1F. Complete the sentences.

Question 1.

An agent of Depository is called as _____________

Answer:

Depository Participant

Question 2.

An investor who opens an account with the Depository participant is known as _____________

Answer:

Beneficial Owner

Question 3.

An account through which the Securities are held in electronic form is called as _____________

Answer:

Demat A/c

![]()

Question 4.

For converting physical Securities into electronic Securities an investor has to submit _____________

Answer:

Demat Request Form (DRF)

Question 5.

For converting electronic Securities into physical certificates an investor has to submit _____________

Answer:

Remat Request Form (RRF)

1G. Select the correct option from the bracket.

Question 1.

| Group ‘A’ | Group ‘B’ |

| (a) Depository Participant | (1) ………………………. |

| (b) …………………… | (2) Holds securities electronically |

| (c) Issuer | (3) ……………………… |

| (d) ……………………. | (4) Investor |

(Beneficial owner, Depository, Links investor and depository, Company issuing securities)

Answer:

| Group ‘A’ | Group ‘B’ |

| (a) Depository Participant | (1) Links investor and depository |

| (b) Depository | (2) Holds securities electronically |

| (c) Issuer | (3) Company issuing securities |

| (d) Beneficial owner | (4) Investor |

1H. Answer in one sentence.

Question 1.

Who is the Beneficial Owner?

Answer:

The investor in whose name Securities are credited to his Demat A/c is the ‘Beneficial Owner’.

![]()

Question 2.

What are the two modes of holding securities?

Answer:

The two modes of holding securities are:

- Physical

- Electronic

Question 3.

When and where was the world’s first depository system set up?

Answer:

The world’s first depository system was set up in Germany in 1947.

Question 4.

What is Corporate Action?

Answer:

When the investor accounts get automatically credited/debited for securities in case of change initiated by the company is called Corporate Action.

Question 5.

Who is the Issuer?

Answer:

The issuer is the company that issues securities in the dematerialized form.

Question 6.

What is the full form of IPO?

Answer:

IPO means Initial Public Offer.

2. Explain the following terms/concepts.

Question 1.

Depository

Answer:

- It is an organization like the Central Bank where securities are held in electronic form at the investor’s request.

- It also provides different services related to different transactions in such securities.

- It is responsible for the safe-keeping of the investor’s securities.

- There is no direct access of investors with the Depository.

- It works as a link between the company and investors.

Question 2.

Depository Participant (DP)

Answer:

- Depository Participant is an agent of Depository who is registered under the SEBI Act.

- He acts as a link between the Depository and the investor.

![]()

Question 3.

Beneficial Owner (BO)

Answer:

- The BO is the investor of securities who have accepted the services of a Depository Participant.

- The BO can also be called Client of Depository and DP. BO is given a unique account number in which securities are held.

Question 4.

Off Market Trade

Answer:

- Trade settled between two parties i.e. transferor or transferee on certain agreed terms without the involvement of the third party i.e. clearing corporation, share broker, or stock exchange is called, ‘Off Market Trade’.

- For e.g. Legacy transfers, gifts, shifting of securities between a client and a sub-broker, etc.

Question 5.

Market Trade

Answer:

Trade settled between two parties i.e. transferor or transferee with the help of the third party i.e. clearing corporation, share broker, or stock exchange is called, ‘Market Trade’.

3. Study the following case/situation and express your opinion.

1. KPCL Bank is a well-established banking institution. Now, it got registered as a Depository Participant.

Question (a).

Under which act did KPCL Bank got registered as a DP?

Answer:

Under SEBI Act, KPCL Bank got registered as a DP.

Question (b).

KPCL Bank as an intermediary will be a link between whom?

Answer:

KPCL Bank as an intermediary will be a link between the Depository and the investor.

Question (c).

Name the two depositories in India, of whom KPCL Bank can be a DP (Agent).

Answer:

NSDL and CDSL.

![]()

2. Mr.K wants to rematerialize his 50 shares of PQR Ltd.

Question (a).

Which form he is required to fill as a written request to the DP?

Answer:

He is required to fill Remat Request Form (RRF).

Question (b).

Does he have to fill instrument of transfer if he wishes to transfer the same after remit?

Answer:

Yes. He needs to fill instrument of transfer if he wishes to transfer the same after remit.

Question (c).

Does he have to quote certificate no. and distinctive no. if he wishes to transfer his shares after it is in remat form?

Answer:

Yes, he has to quote certificate no. and distinctive no. if he wishes to transfer his shares after it is in Remat form.

3. Mariam is a broker working with Abacus Co.

Question (a).

Who is the depositor?

Answer:

Abacus Co is the depositor.

Question (b).

Who is the depository participant?

Answer:

Mariam is a depositor participant.

Question (c).

Mariam should be registered with whom?

Answer:

Mariam being the broker must be registered with SEBI and comply with SEBI norms.

4. Distinguish between the following.

Question 1.

Depository and Depository Participant.

Answer:

| Points | Depository | Depository Participant |

| 1. Meaning | A depository is an entity that helps the investor to buy or sell securities online. | A depository participant is a link between companies and investors. |

| 2. Types | There are two depositories functional in India. They are NSDL and CDSL. | Various depository participants are linked to NSDL and CDSL. |

| 3. Who can be? | A Depository may be organizations, banks, or institutions. | A Depository Participant can be a bank, financial institution, a broker. |

| 4. Registered | Depositories must be registered as a company under the Companies Act and obtain a Certificate of Commencement of business from SEBI. | Depository Participants should be registered under the SEBI Act. |

Question 2.

NSDL and CDSL

Answer:

| Points | NSDL | CDSL |

| 1. Full Form | NSDL means National Securities Depository Ltd. | CDSL means Central Depository Services India Ltd. |

| 2. Formed | NSDL was formed in 1996 | CDSL was formed in 1999 |

| 3. Works for | NSDL mainly works for National Stock Exchange (NSE) | CDSL mainly works for the Bombay Stock Exchange(BSE) |

| 4. Registered | Depositories must be registered as a company under the Companies Act and obtain a Certificate of Commencement of business from SEBI. | Depository Participants should be registered under the SEBI Act. |

5. Answer the brief.

Question 1.

What are the two ways of holding securities?

Answer:

There are two ways of holding the securities:

(i) Physical mode:

Securities are held in physical form i.e. paper form. Holding securities in physical form is riskier as it can be torn, misplaced, stolen, damaged, etc. It also consumes a lot of time in storing and handling certificates and documents. Transfer and Transmission of shares is a time-consuming process.

(ii) Electronic/Dematerialized:

In this system, securities are held in electronic or dematerialized form. Holding securities in electronic form is a safe and secure way. It saves a lot of time in storing and handling certificates and documents. Transfer and Transmission of shares is a time-saving process. The electronic system is a much faster and easier system of holding securities.

![]()

Question 2.

Explain Depository System. State its importance.

Answer:

A depository system is a system, where securities are held in electronic form. The transfer and settlement of securities are done electronically. On behalf of shareholders, the Depository System maintains accounts of the shareholder, enables transfer, collects dividends, bonus shares, etc.

It is also known as, ‘Scripless trading system’. The Depository Act was passed in the year 1996 under which the depository system was introduced. NSDL and CDSL are the two depositories operating in India.

Importance of Depository System:

- Depository plays a very important role in the smooth functioning of the capital market.

- Reduced paperwork: The aim of the depository system is to reduce the paperwork. It is scriptless system.

- Use of Technology: Paperless trading is possible as it uses the technology. It facilitates electronic transfer.

- Elimination of Storage and handing: As it is a scriptless system storing and handing of certificates work gets eliminated.

- Reduces cost and efforts: Depository system the cost and efforts involved in storage and handling of physical certificates.

Question 3.

Explain the various concepts/terms related to Depository System:

Answer:

(i) Dematerialization:

It is the process in which share certificates are converted into electronic form. The client has to open a DEMAT account with the help of DP.

(ii) Fungibility:

Fungibility means interchangeable. Financial assets may or may not be fungible. The shares in depositories are fungible. They don’t have distinctive numbers for identification.

(iii) Rematerialization:

Rematerialization is the process in which shares are reconverted into physical form.

(iv) International Securities Identification Number:

ISIN is an identification number given to a security of an issuer company at the time of issuing such security for the first time in the depository system. ISIN consists of a 12 (Twelve) digit alpha-numeric code which is divided into 3 (Three) parts. For Govt, securities allotment of ISIN is done by the RBI & for others by NSDL. It is accepted globally.

Question 4.

How many depositories are established in India, under the Depository Act of 1996?

Answer:

There are two depositories established in India under the Depository Act of 1996:

(i) NSDL (National Security Depository Limited):

- NSDL is the first and the largest depository in India established in November 1996.

- It is established by IDBI (Industrial Development Bank of India), Unit Trust of India (UTI), and National Stock Exchange (NSE).

- NSDL has its headquarters in Mumbai.

- It is registered under the Companies Act as a Public Limited Company.

- Investors, Stock Exchanges, Banks, Clearing Members, etc. receive a variety of services from NSDL.

- Services provided by NSDL include account maintenance, dematerialization, rematerialization, settlement of trades through market transfers and off-market transfer, nomination, transmission, distribution of noncash corporate actions, dividend distributions, facility of freezing, or locking of investors’ accounts, Investor grievances, etc.

(ii) CDSL (Central Depository Services Limited:

- CDSL began its operations in February 1999.

- It was promoted by the Bombay Stock Exchange jointly with several banks.

- The headquarters of CDSL is in Mumbai.

- CDSL also offers Demat services like NSDL across the country and has a wide DP network.

- NSDL and CDSL have played a great role in the success of the Depository System in India.

![]()

6. Justify the following statements.

Question 1.

The depository system has some advantages to the Investor.

Answer:

- The depository system holds certificates of the Investor in an electronic form.

- Safety is ensured as the entire system functions under the Depository Act and is monitored by SEBI.

- The investor even can freeze his account to avoid fraud.

- Investors can easily transfer the securities in electronic form.

- The investor receives a statement of account periodically which keeps him updated.

- Investors can raise easy loans against the Dematerialized securities.

- A nomination facility is also available for investors.

- Dividend, Bonus Shares, Right Issue, Redemption amount gets automatically credited to Investors account.

- Thus, it is rightly justified that Depository systems have some advantages to the investor.

Question 2.

An investor can raise loan against dematerialized securities.

Answer:

- Investors can take a loan against securities (shares, debentures, bonds, mutual fund units) that are held in their Demat accounts.

- The time required for the documentation process to take loans is less.

- In order to raise a loan against dematerialized securities, both the borrower and lender should have Demat accounts with the same depository

- The Demat accounts can be held with the same or different depository participant (DP).

- Thus, it is rightly said that investors can raise loans against dematerialized securities.

Question 3.

Better and quicker services of the Depository system attract investment from abroad.

Answer:

- Paperless trading is a boon for company management.

- Automatic and transparent screen-based trading in securities, shorter settlement periods have improved liquidity in investment in securities.

- The transfer process under the depository system is prompt and free from defects.

- The company is able to know the particulars of beneficial owners and their holdings periodically.

- Thus, it is rightly said that Better and quicker services of the Depository system attract investment from abroad.

Question 4.

It is necessary for the Beneficial Owner to open a DEMAT account with the DP.

Answer:

- The beneficial Owner is the investor of the company.

- For holding the securities in electronic form, it is necessary to open a DEMAT account.

- DEMAT account can be opened with the help of DP.

- The BO can also be called a client of Depository and DP.

- BO has to pay charges to the DP for availing the services of DP.

- BO is entitled to all rights, benefits and is subject to all liabilities with respect to securities.

- BO is given a unique account number in which securities are held.

- Thus, it is rightly said that it is necessary for the Beneficial Owner to open a DEMAT account with the DP.

![]()

7. Answer the following questions.

Question 1.

What is the procedure for the Transfer of Securities under the Depository System in case of the sale of shares?

Answer:

When shares are sold the Transferor (Investor) has to inform his DP by issuing Delivery Instruction Slip (DIS) duly filled and signed with the details of the security sold. At the end of the transaction, the said securities are debited from his Demat Account.

Transfer of shares can be done in two ways:

(i) Off Market Trade:

Trade settled between two parties i.e. transferor or transferee on certain agreed terms without the involvement of the third party i.e. clearing corporation, share broker, or stock exchange is called, ‘Off Market Trade’. For e.g. Legacy transfers, gifts, shifting of securities between a client and a sub-broker, etc.

Procedure:

- Seller i.e. the transferor gives instructions to the DP to transfer securities from the seller’s account to the buyer’s account.

- The buyer i.e. transferee will get securities credited to his account through his DP. DP will transfer the securities only after receiving confirmation from the depository.

- The transferee will directly pay the money to the transferor.

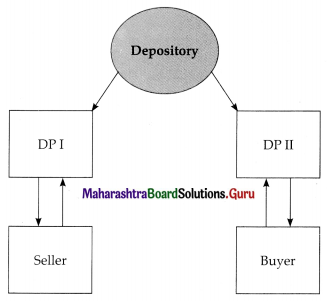

Diagrammatic presentation:

(ii) Market Trade:

Trade settled between two parties i.e. transferor or transferee with the help of the third party i.e. clearing corporation, share broker, or stock exchange is called, ‘Market Trade’.

Procedure:

- The Seller i.e. the transferor gives instruction to his DP. The securities are then transferred from Transferor’s account to the Transferor’s Broker account.

- From the Transferor’s Brokers account securities are transferred to the clearinghouse of the Stock Exchange.

- On the pay-out day, securities move from the clearinghouse to the account of the broker of the transferee.

- After instructions and confirmation from Depository, securities are transferred to the buyer’s account.

8. Attempt the following.

Question 1.

Explain the process of Dematerialisation?

Answer:

Dematerialization is the process of converting physical certificates into electronic form/mode. When an investor opts for a depository system, he has to approach a Depository participant, who is the authorized agent of the depository. The investor needs to surrender his share certificate to the company through a depository participants. On confirmation from the company and Depository DP arranges to credit investors account with an equivalent number of shares.

Following steps are involved in the process of Dematerialisation:

- Submission of DRF by Investor: The investor has to submit the DRF (Demat Request Form) in triplicate and original certificates to DP.

- Entry in the system and forwarding request to Depository: DP enters the details of Demat request in the system and sends it to the Depository.

- Forwarding Copy to the Issuer: DP sends the physical certificates and copy of DRF to the Issuer i.e. Company

- Verification by the Issuer: The Issuer (Company) verifies and confirms to Depository about dematerializing of the securities.

- Updating records by the Depository: Depository records the request in the system and forwards it to the Issuer Company.

- Intimation to the DP: Depositor credits the dematerialized securities to the beneficiary/investors Demat A/c and informs the DP.

- Intimation to the investor: A statement of account is issued to the Investor periodically. It contains all the details of the investor.

![]()

Question 2.

Explain the functioning of the depository under the IPO scheme.

Answer:

IPO is the first sale of shares by a privately owned company to the general public. A public company can raise capital by making an appeal to the general public to purchase shares of the company by issuing a prospectus.

The process of IPO is as follows:

- Submission of Application: The investor (applicant/BO) has to submit an application for securities to the issuer company.

- Verification with Depository: The details of the investor are verified by the company with Depository.

- Report by Depository: After verification depository submits the investors report to the issuer company

- Details of Allotment: The issuer company submits the details of allotment to the depository for updating their records.

- Crediting the account: The depository credits the account of the beneficial owner with a specific number of securities.

- Intimation to the DP: Depository then informs the Depository Participant (DP) about the details of the beneficial owner account.

- Intimation to the BO: Depository Participant informs the beneficial owner (investor) about his investment through Statement of Accounts.